How to Rein in Rising Insurance Costs

GPS tracking and telematics software help lower insurance costs.

Insurance is one of those things you may not really think about until your business needs it. That is, unless you’re facing skyrocketing premiums or, worse, shrinking access to coverage itself, which is what’s happening to truck fleets. Negative trends impacting the insurance market’s view of trucking are forcing more fleet managers to think a lot more about insurance.

Fleets are facing what commercial-insurance broker Hub International defines as a “hardened insurance market,” in which premiums have not only gone up, but in many cases have doubled. “With increases between 10% and 15% for the third year in a row, policies are no longer just 3% to 4% of a fleet’s annual revenue — they can approach north of 7.5%.”

Reining in insurance costs requires looking at your operation the way an underwriter does. Is your fleet, at bare minimum, a calculated but acceptable risk for an insurance carrier to take on? Or does everything about your operation scream disaster about to happen?

To be sure, you are not alone in facing the insurance juggernaut. In its latest survey on the top issues confronting trucking, the American Transportation Research Institute, which is part of the ATA Federation, identified insurance cost and availability as an emerging issue.

Since 2013, per ATRI data, fleets surveyed have been walloped by insurance premium costs that have jumped over 17%. ATRI states that rate hikes are being “driven by a number of factors, including increasing costs associated with: equipment repair, rising medical costs, higher jury awards and settlement costs, and greater safety and legal exposure.

Underscoring how serious the threat is, ATRI has pegged as a top research priority the impact of so-called “nuclear verdicts,” massive punitive damages of over $10 million, on truck fleets. The researchers will document and quantify historical trends associated with growing jury awards and out-of-court settlements resulting from negligence cases and other tort suits brought against trucking companies.

While the rise in nuclear verdicts can be, and are, blamed on personal-injury lawyers who are very good at their jobs, the fact that trucks can be involved in horrific accidents is arguably the biggest factor. Some crashes can’t be avoided, and no driver or employer should be blamed for them. But in the current tort-happy legal climate, it behooves all truck operators to do all they reasonably can to prevent or mitigate accidents on the road, especially calamitous ones.

Risky Environment

“Significantly minimizing the cost of insurance is unlikely in the current environment,” contends Keith Dunlap, transportation practice leader and senior vice president for Gallagher Bassett, a global claims-services provider. “There are too many issues insurers are facing today, from the high cost of defense, to unreasonable plaintiffs’ attorneys with unreasonable demands, to year-over-year escalating loss costs. And until there is meaningful tort reform implemented by state legislators, I don’t think it is possible to lower insurance pricing significantly.”

That being said, he also points out that, “exceptionally well-run trucking companies with experience, owned equipment, low driver turnover, minimal loss activity, a commitment to a telematics investment, and impeccable CSA scores are in a better position to gain access to more insurers with better pricing than those that don’t stand out as best-in-class companies.”

Dunlap adds that commercial insurers have “a much higher chance of achieving better outcomes on claims with focused third-party [claims] administrators managing expectations” of liability claims.

Third-party claims administrators for commercial liability insurance providers act much like claims adjusters. They may work with the insurance company’s internal claims adjuster as well as outside claims investigators and defense counsel in the event of lawsuits.

Speaking of defending against the rise of nuclear verdicts, Dunlap warns that “hiring marginally acceptable employees” has helped lead to “exploitation by skilled plaintiff’s lawyers.

“This leads to negligent hiring and retention claims against the motor carrier, all in a concentrated effort to support gross negligence and punitive damage claims, maximizing recovery,” he says. “These efforts can result in higher jury awards, adversely affecting insurers who write [policies]in the trucking space. Those insurers then increase their rates across their entire book of commercial auto business.”

Dunlap advises that the “only way any motor carrier can truly protect themselves against allegations of negligent hiring today is to maintain a driver qualification file that can withstand scrutiny. Truckers need to comply with each of the seven hiring processes outlined in the Federal Motor Carrier Safety Regulations [49 CFR 391], which outlines the minimum requirements for hiring commercial motor vehicle drivers.”

Eyes and Minds

Whenever a driver is involved in an accident, both driver and employer can be targeted by a break-the-bank personal injury suit. One way to combat that is to do all you can to prevent distracted driving, advises law firm Franklin & Prokopik in its transportation-practice blog.

The firm states that “in trials that result in massive civil judgments, awards for punitive damages, if sought, far exceed awards for compensatory damages….the reason for this trend may be rather simple: With an increase in commercial vehicle accidents involving a distracted driving component, the transportation industry has seen an increase in nuclear verdicts.”

As Franklin & Prokopik sees it, there’s a common thread to nuclear verdicts. “There exists some act leading to distracted driving, whether visual, physical, or cognitive, and an element of preventability and accountability on behalf of the carriers and trucking companies. There is no dispute that distracted driving significantly increases the likelihood of catastrophic accidents. The recent nuclear verdicts in cases involving commercial vehicle accidents with a distracted driving component make clear that juries will hold not just the driver accountable, but the motor carrier accountable as well for the safety of the public on the roadways.”

Although distracted driving can be the root of many horrific crashes, it is of course not the only cause of poor safety performance that can drive up insurance premiums and even lead to a denial of coverage for a truck fleet.

Here’s where managers roll up their sleeves and dig into their safety stats to identify what needs fixing first and foremost to make their fleet attractive to insurers. The tools used may be soft-touch, such as improving driver recruitment and retention to hire the best possible drivers, or hard-edged, like leveraging telematics and spec’ing advanced safety equipment.

The results of these efforts need to be measured and the goals set for them continually updated to present the fleet to insurance underwriters with the most flattering loss-ratio profile possible.

Tell a Positive Story

“Insurers want to work with fleets. Particularly insurance brokers. They want to make sure their customer [risk profile] is attractive to underwriters,” says Mark Murrell, co-founder of CarriersEdge, which works with a number of insurance providers that resell the company’s online driver training modules. CarriersEdge also co-produces the annual Best Fleets to Drive For program.

Murrell says there are “starting points” to building a positive profile, including showing proof of documented safety policies for drivers and managers and proof they are followed, such as by documenting training.

“More training equals a better safety profile,” Murrell contends. “And insurers want to see how much is done in terms of follow-up to any training. Some may want to see it in print or electronic form. But my guess is they will take what they can get to work with.” They’ll also want the training regimen organized with drivers methodically tracked. “They don’t want to see a room full of boxes” of training material.

“Keeping the materials online will make it easier to pull up reports,” he adds. “Since it can be billable work for a broker to work up profiles, being organized will save the trucking company money — as will the broker being able to tell a better story about the fleet to an underwriter.”

“Improving a fleet’s safety profile is seldom a one-time fix,” says Chad Hoppenjan, assistant vice president of Safety Management Services Company, a safety and risk-management consultancy. “We see the most success with clients who continuously work on it.”

He says when SMSC presents its safety assessment, customers “more often than not are very receptive. We work with them, but we can’t tell them what to do.” Improving a risk profile is a process, “not something you can change overnight. What you do is work in this policy year to improve for the next year.”

For Hoppenjan, key elements of a safety review should include top-down management commitment; hiring quality drivers and then retaining them; making sure operational, sales, and driver-manager teams are all accountable for safety; and focusing on reducing “loss leaders” in the fleet and zeroing in on “real safety issues, not perceived ones.”

Don’t Hire Problems

Drivers are at the heart of the safety equation, or as Hoppenjan puts it, “You don’t want to hire problems and then continue to have problems throughout their employment. What I stress is to not take your current qualified drivers for granted. If you can retain them, you will not have to hire so many later on.

“And you don’t want to set up drivers to fail,” he continues. “Basically, that means not putting them into a bad position, such as loads scheduled too tightly, that can push them to be unsafe by driving too fast and hard.”

Hoppenjan stresses holding accountable everyone who may impact driver safety. “For example, evaluate driver-managers on crashes/injuries per driver and moving violations per driver. See who stands out and why. And address those [managers] who may be a part of causing safety issues.” Similarly, don’t let sales “overpromise shippers.”

Determine your loss leaders (vehicles and injuries) in terms of both losses and compliance. “Base this on your real data, not data distorted by the one severe incident that may have happened recently,” he recommends. “For example, if you’re using event recorders, are you seeing an upswing in following too close? If you can control these kinds of losses, it can only help with insurance rates.”

Keep in mind that the latest technology developments, everything from event recorders to collision-mitigation systems, “are all huge” in helping drive up safety performance, Hopperjan notes.

Technology Teaches

The various active safety systems now available on trucks, as well as event recorders and cab-mounted video systems fleets install, are constantly delivering a rich flow of actionable data to inform a fleet’s safety assessment and training efforts.

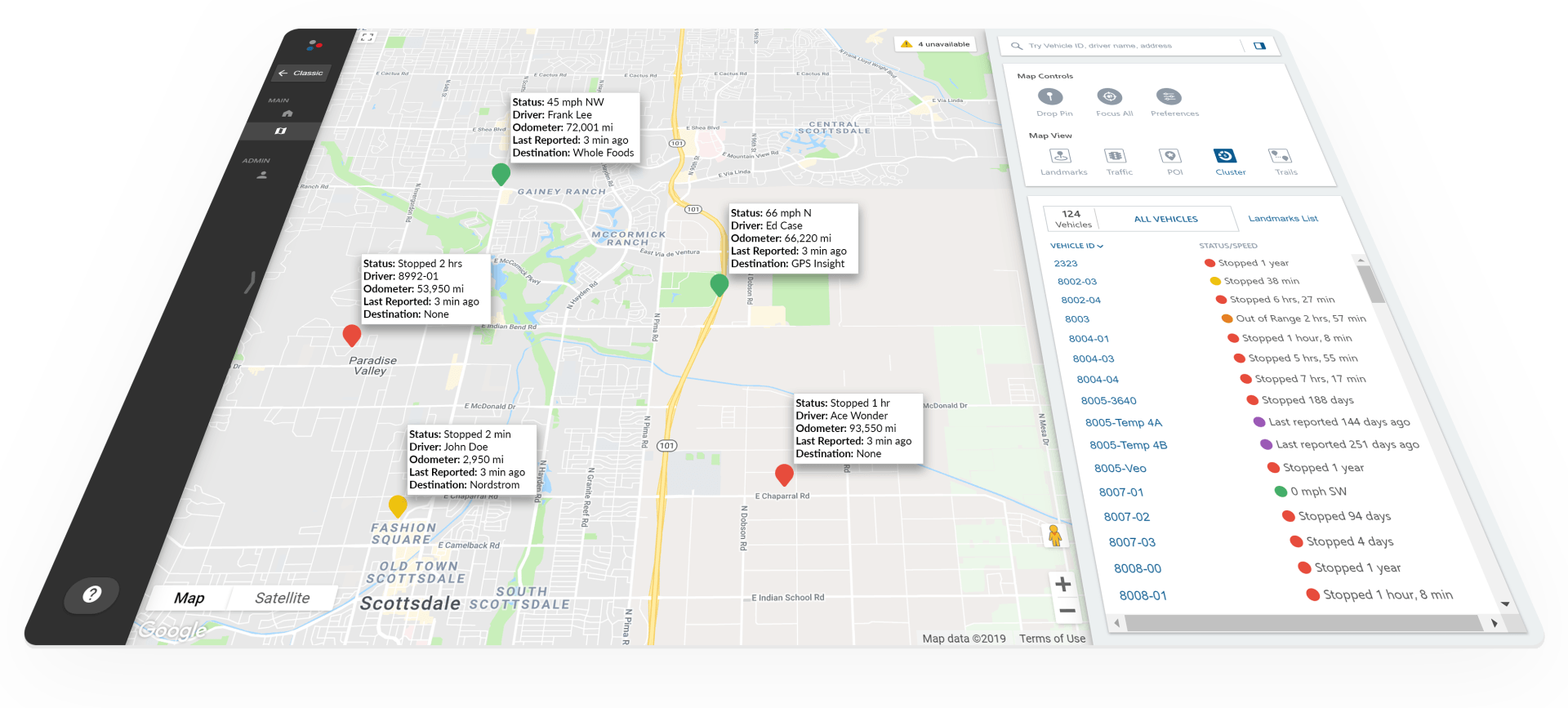

“Of the top fleets in the United States, the majority have implemented some type of telematics,” points out Gallagher Bassett’s Dunlap. “These motor carriers understand how collision-avoidance technology, auto braking systems, and video captures help reduce both the frequency and severity of loss. They also understand how implementing telematics helps protect against meritless claims by third-party attorneys. In my view, this is a key risk-management investment.”

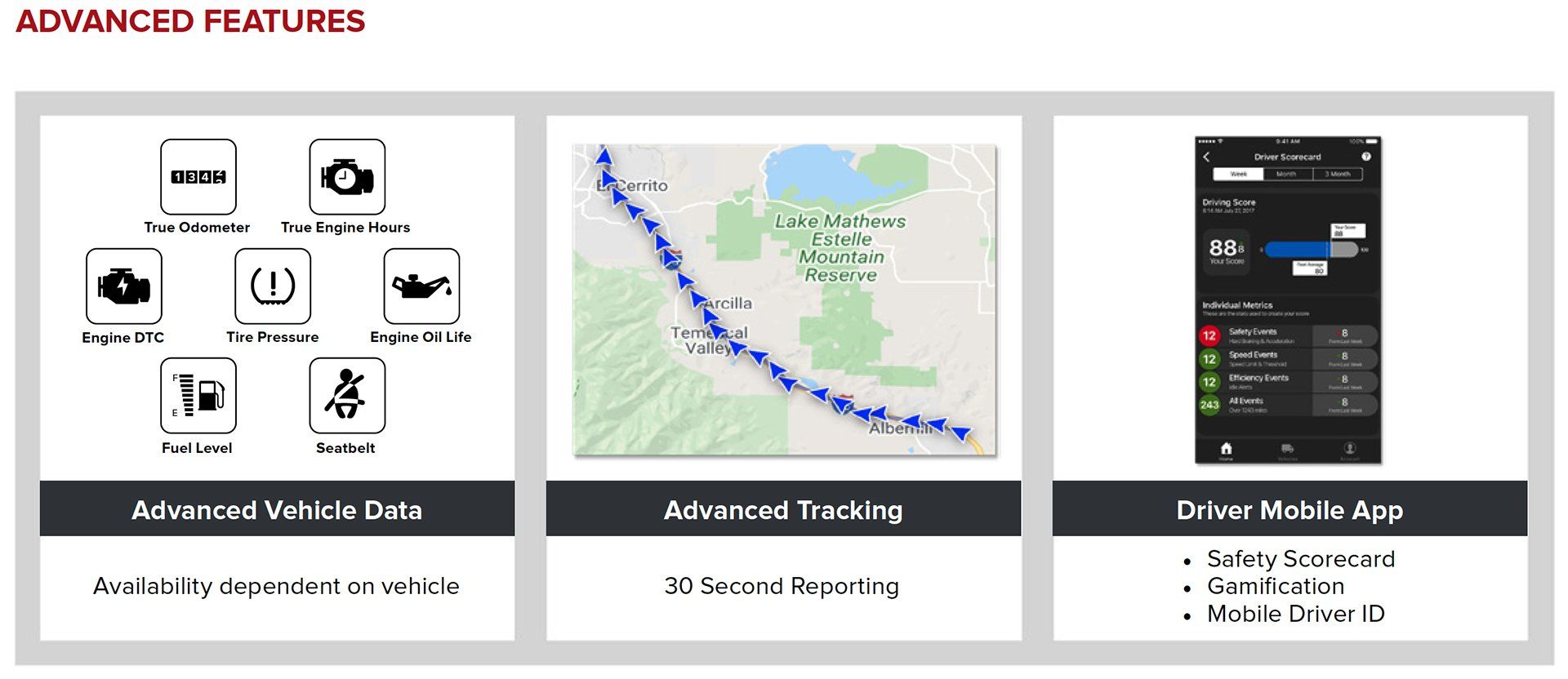

The electronic logging device mandate has almost every fleet now using some type of telematics, points out a Hub International trend report. “There is an incredible amount of information that can be harvested to improve both operations and safety if used correctly,” the brokerage states.

Telematics can include video systems to improve safe driving practices and to exonerate drivers in crashes that could not be prevented, as well as information about the speed, location, and mechanical condition of trucks. “How this information is shared with drivers, management, and customers can have a direct impact on the performance of the organization,” Hub says.

Attitude Adjustment

“I met with several underwriters recently, and they are hot about telematics,” says Terry Lutz, vice president of risk management for Transervice Logistics, which operates trucks on dedicated routes and contract carriage, along with providing full-service leasing and freight brokering. “Crash avoidance, forward and rear-facing cameras, all play a part.

“Something else that’s important to bringing down premiums is the culture of your organization,” she continues. “Is management connected with safety? It should not be an issue to get top management to weigh in” on policies and investments.

Lutz agrees it’s a tough market for insurance. “Most carriers that score poorly on safety will go out of business because they won’t be able to pay for expensive umbrella premiums.”

She notes that some insurance firms have exited the trucking market altogether. “Others will only now play at the higher level — fleets with the best safety records — or they may set lower coverage limits, maybe $3 million to $7 million instead of $10 million, or they will put in a 20% to 30% rate hike.”

Fleets need to work with their insurance brokers, Lutz advises. “You can’t have the attitude, ‘That’s what insurance is for’ when something goes wrong... [do that and] you will eventually be loss-rated and you will pay.”

Re-posted from HDT Truckinginfo January 8, 2020 by David Cullen

Let See The Fleet help you rein in your insurance costs!

Quick Links

Quick Contact

2310 Michigan Ct, Ste. D, Arlington, Texas 76016

Monday through Friday

8 am – 5 pm

Google Wallet